EU Conflict Minerals Regulation vs. U.S. Dodd-Frank Act Section 1502

Tin, tungsten, tantalum, and gold are essential minerals that make up countless everyday materials and products, such as electronics, jewelry, tools, glass, connecting wires, and more. These four minerals are considered conflict minerals by the U.S. and EU governments. Conflict minerals, otherwise known as 3TG, are typically sourced from areas plagued with governmental instability, armed violence, and human rights abuses. The profits from mining conflict minerals are primarily used to fund the groups responsible for these issues, thus perpetuating a cycle of violence.

In efforts to reduce the negative impacts associated with mining these minerals, increase companies’ accountability for sourcing 3TG, and improve supply chain transparency, the U.S. and the EU passed their own respective conflict minerals compliance requirements. We know these requirements as the U.S. Dodd-Frank Act and the EU Conflict Minerals Regulation. While similar, there are some key differences between the two. Continue reading to learn more.

EU Conflict Minerals Regulation

The EU Conflict Minerals Regulation was enacted on January 1, 2021. The regulation applies to EU-based importers of 3TG sourced from conflict-affected and high-risk areas (CAHRAs). All imported 3TG is subject to regulation, including processed metals, mineral ores, or concentrates.

EU Conflict Minerals Regulation Reporting Requirements

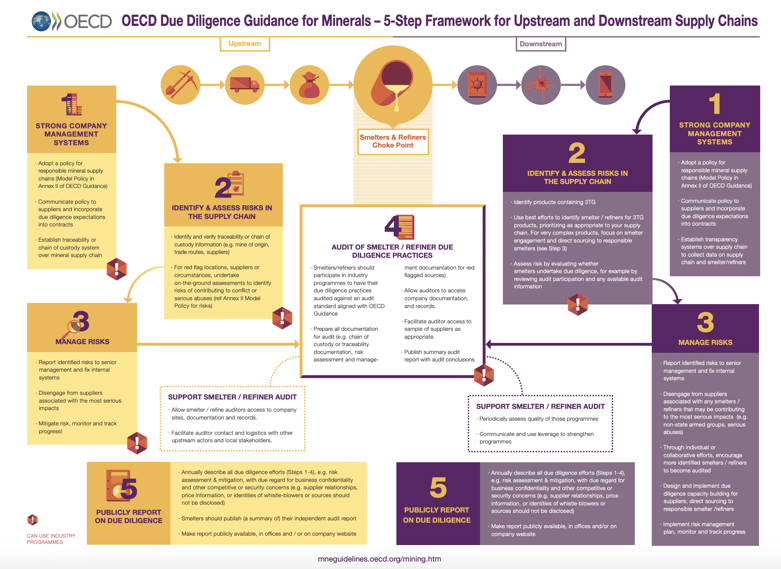

The EU Conflict Minerals Regulation has different 3TG compliance and reporting guidelines for upstream and downstream companies. Upstream companies – which include operations involved with mines, smelters, refiners, etc. - fall within the scope of the regulation, meaning they must conduct due diligence and report on imported 3TG. Downstream companies that import or distribute end-user products containing 3TG, or source finished components, are currently exempt from the regulation. However, downstream companies are encouraged to report on their use of 3TG voluntarily.As of now, the EU Conflict Minerals Regulation does not have an exact format for 3TG reporting, but upstream companies are required to follow the Organization for Economic Cooperation and Development (OECD) Guidance. Additional requirements for upstream companies include the following:

- Sharing supply chain data with downstream purchasers

- Publicly reporting due diligence policies and practices

- Publishing summary reports of annual third-party supply chain audits

OECD Due Diligence Guidance for Conflict Minerals - 5-Step Framework

The OECD Due Diligence Guidance has a 5-step framework for upstream and downstream companies. This resource from the OECD breaks down the process.

U.S. Dodd-Frank Act Section 1502

The U.S. Dodd-Frank Act was enacted on July 21, 2010, with a specific section – Section 1502 – focused on conflict minerals compliance. Section 1502 applies to publicly traded companies that manufacture products containing 3TG sourced from the Democratic Republic of the Congo (DRC) or any surrounding countries within the scope of the regulation.

Dodd-Frank Act Section 1502 Conflict Minerals Reporting Requirements

If 3TG is necessary for the functionality or production of a product, the product falls within the scope of Section 1502. This requires public companies to conduct due diligence by tracing the 3TG back to the utilized smelter to determine where the minerals originated.

Unlike the EU regulation, Section 1502 of the Dodd-Frank Act has an established 3TG reporting process. Once 3TG is determined to be essential to the functionality or production of a product, the following steps must be taken:

- File a Report with the U.S. Securities and Exchange Commission (SEC).

- Trace 3TG back to the smelter of origin via a Reasonable Country of Origin Inquiry (RCOI) to determine if the minerals originated from the DRC or surrounding countries.

- Complete the Form SD to verify how the origin of the 3TG was determined.

- If the 3TG did not originate from the DRC or surrounding countries, the results from the RCOI must be included in the Form SD.

- If the 3TG did originate from the DRC or surrounding countries – and was not sourced from scrap or recycled materials – due diligence must be conducted in the form of a Conflict Minerals Report (CMR).

Public companies required to file a CMR must follow the due diligence process of a nationally or internationally recognized framework, such as the OECD Due Diligence Guidance. The due diligence process results in one of three determinations, each with its own set of requirements.

Key Differences Between the EU Conflict Minerals Regulation and Section 1502 of the U.S. Dodd-Frank Act

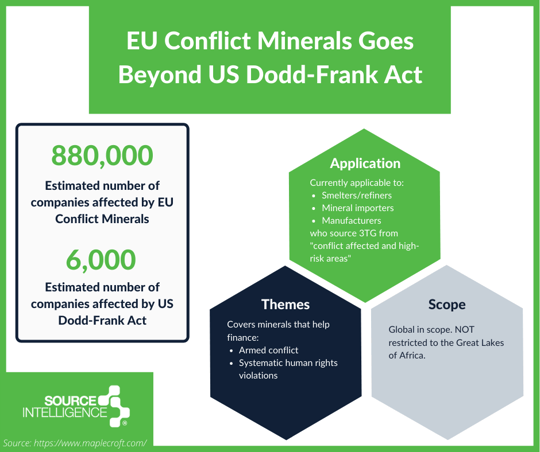

While the EU Conflict Minerals Regulation was inspired by Section 1502 of the U.S. Dodd-Frank Act, they differ in significant ways. The key differences include the following:

- Application – Section 1502 of the U.S. Dodd-Frank Act applies to U.S. publicly traded companies that manufacture products containing 3TG. The EU Conflict Minerals Regulation applies to upstream companies in the supply chain, which includes importers, local traders, and operations involved with mines, smelters, and refiners. The EU regulation begins the due diligence process right when 3TG enters the EU, rather than when it is used in the manufacturing of products. This reduces the work involved with going up the supply chain to identify the source of 3TG.

- Scope – The U.S. Dodd-Frank Act covers 3TG sourced from the DRC and surrounding countries, which includes Angola, Burundi, Central African Republic, Republic of the Congo, Rwanda, South Sudan, Tanzania, Uganda, and Zambia. The EU Conflict Minerals Regulation covers 3TG sourced from any CAHRA, which means it has a larger, more global scope than that of the U.S.

- Reporting Process – The due diligence reporting process for the U.S. is more robust than that of the EU. The U.S. has a step-by-step process established by the SEC, while the EU regulation does not yet have an established reporting process. However, both encourage the use of an international due diligence framework, namely the OECD Due Diligence Guidance.

The following graphic provides a visual representation of how the EU Conflict Minerals Regulation goes beyond Section 1502 of the U.S. Dodd-Frank Act.

Conflict Minerals Reporting Software

Source Intelligence is the leading solution provider of conflict minerals compliance software for both the U.S. Dodd-Frank Act and the EU Conflict Minerals Regulation. Upload your suppliers to our extensive database, request and collect conflict minerals reporting templates (CMRTs) and analyze your supply chain data with visual reports in a single platform.

We’ve helped thousands of companies achieve comprehensive supply chain transparency. Contact us today to discover what we can do for your business.